By SVN | Vanguard Commercial Real Estate Advisors, San Diego, CA

April 16, 2025

In this month’s economic update, we explore the shifting tides of small business sentiment, consumer behavior, real estate sectors, and employment data. Whether you’re an investor, developer, or just keeping a pulse on the market, here’s what you need to know to make informed, strategic decisions in Q2.

According to the National Federation of Independent Business (NFIB), small business optimism in March 2025 saw its sharpest monthly drop in nearly three years. Just 21% of business owners expect future conditions to improve, down significantly from February’s outlook. Only 3% anticipate increased sales in the short term.

Interestingly, the same business outlook components that surged following the November 2024 election have now reversed course, underscoring the volatile nature of political and economic sentiment.

What this means: Small businesses are approaching the next quarter cautiously. Expect scaled-back hiring, fewer expansion plans, and more risk-averse investment behavior across the board.

Morning Consult’s daily index shows consumer confidence experienced its second-largest three-day drop since the onset of the COVID-19 pandemic. After a post-election boost that carried into early 2025, consumer sentiment has been steadily declining.

While spending remained soft in February, forecasters anticipate a slight seasonal rebound due to the Easter holiday. Still, current trends suggest consumers are tightening their budgets in response to uncertainty around tariffs and broader inflation concerns.

The Logistics Managers’ Index (LMI) fell sharply from 62.8 in February to 57.1 in March, one of the steepest declines in its history. The drop is largely attributed to a cooldown in inventory costs, transportation prices, and warehouse demand—indicators that suggest the early-year rush to get ahead of tariffs has eased.

Although a reading above 50 still signals expansion, this downturn marks the shortest growth cycle in logistics in the past seven months.

Medical outpatient buildings (MOBs) are proving resilient in an otherwise cautious real estate environment. Asking rents increased 2.5% in 2024, and high-end properties led the way with stronger-than-average net operating income (NOI) growth.

With over 80% tenant retention rates and lease terms averaging nearly nine years, MOBs are drawing attention for their stability and long-term cash flow potential. Vacancy remains low at just 6.9%, further supporting investor confidence in this sector.

The National Multifamily Housing Council (NMHC) reports that 58% of developers are experiencing delays in Q1 2025—an improvement from the 78% figure at the end of 2024. Permitting remains the most common issue, followed by delays related to economic feasibility and professional services.

Geographically, the Southeast and Texas are facing more persistent slowdowns. While construction financing and labor shortages are improving, regulatory hurdles continue to test developer timelines.

The March jobs report from the Bureau of Labor Statistics delivered a surprise upside: 228,000 jobs were added, exceeding projections of 140,000. Healthcare and transportation led job growth, while the federal government continued trimming its workforce.

The unemployment rate ticked up slightly to 4.2%, but investor sentiment shifted toward a more dovish Federal Reserve stance. Markets are now forecasting a greater chance of multiple rate cuts by year-end.

Despite wavering confidence, the National Retail Federation predicts Easter 2025 spending will reach $23.6 billion, up from $22.4 billion in 2024. Discount stores are expected to capture the bulk of that spend, reinforcing the growing appeal of value-driven retail.

Egg prices, symbolic of seasonal inflation, have nearly doubled—yet Americans are still showing up to spend. Major retailers are optimistic, hoping to replicate December’s robust holiday sales performance.

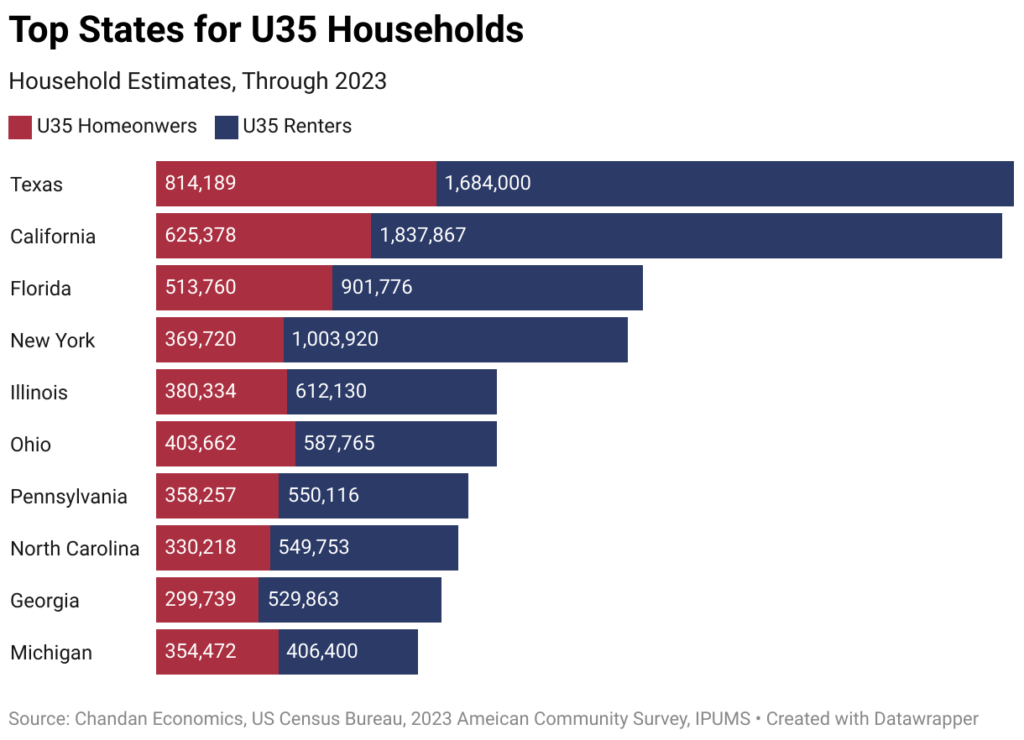

According to a recent analysis by Chandan Economics, Texas, California, and Florida lead the nation in the number of homeowners under age 35. However, when comparing under-35 homeowners as a percentage of all households, Utah, Alaska, and Iowa rank highest—signaling greater affordability.

In contrast, high-income states like California (4.6%), New York (4.8%), and Washington D.C. (3.5%) sit at the bottom, reflecting barriers to homeownership despite above-average wages.

The demand for work-from-home (WFH) rental units has dropped for the second consecutive year. There are now 4.0 million WFH rentals, down from a peak of 5.0 million in 2021. That’s a 20% decline over two years.

The market appears to be normalizing after the remote work surge of the pandemic. However, full-time remote workers are still 152% higher than pre-2020, suggesting long-term shifts remain in play.

The March Federal Open Market Committee (FOMC) meeting minutes reveal that the Fed chose to hold interest rates steady while assessing inflation and labor market signals. Policymakers acknowledged that inflation may run higher than expected due to new tariffs and supply chain pressures.

Most officials now see inflation risks as “tilted to the upside,” while risks to employment are growing on the downside.

While confidence may be shaky and geopolitical unknowns persist, not all sectors are retreating. Healthcare real estate, discount retail, and logistics remain areas of strength. In San Diego and beyond, this is a time to stay strategic—positioning ahead of rate cuts, leveraging tenant demand in core sectors, and anticipating changes in remote work trends.

Work Cited

SVN | Vanguard Commercial Real Estate Advisors.

Economic Update – April 10, 2025. SVN International Corp., 2025.