Through Q3 2025, the Southwest Region — spanning Phoenix, Denver, Las Vegas, and San Diego —continues to shift gears. After a decade marked by rapid absorption, development cycles, and population inflows, the region is now experiencing a measured recalibration. Industrial and retail remain comparatively steady, multifamily is navigating supply and rent pressures, and office keeps evolving as tenants refine their space strategies. Investor sentiment across the region is cautiously optimistic as many watch for signs of bottoming and repositioning opportunities.

Against this backdrop, San Diego stands out for its stability, disciplined supply pipeline, and long-term economic anchors, making it one of the more resilient metros in the Southwest.

San Diego’s commercial real estate landscape continues to be defined by disciplined development, high barriers to entry, and diverse demand drivers—including defense, biotech, tourism, and cross-border logistics. Across all property types, the market is demonstrating moderate softening, but remains fundamentally healthy.

Below is a sector-by-sector breakdown of Q3 2025 conditions and “what this means” for owners, investors, and brokers.

INDUSTRIAL — Still Tight, But Showing Hairline Cracks

San Diego’s industrial market remains one of the strongest in California, but 2025 has introduced selective softening—particularly in older product and in submarkets with big-box availability.

Key Themes

Investor & Owner Implications

What This Means for You:

RETAIL — More Availability, Stable Demand, and Select Big-Box Turnover

San Diego retail is in a transitional year. Availability has increased due to a wave of national retailer closures—including Macy’s, Joann, Kohls, Rite Aid, and Party City—pushing vacancy to its highest level since 2021. However, high-quality space continues to lease quickly.

Key Findings from Q3 Reports

What This Means for CRE Professionals

MULTIFAMILY — Supply Pressure Meets Affordability Limits

The San Diego multifamily market remains demand-heavy but is currently working through the same pressures seen nationally: elevated supply in certain pockets, flattening rents, and competition among Class A operators.

Q3 Multifamily Highlights

Implications

OFFICE — The Slow-Motion Reset Continues

San Diego’s office market continues its multiyear structural transition. Demand is uneven, with the strongest activity coming from professional services, medical office, and life science users.

Q3 Office Takeaways

What This Means for CRE

Across all sectors, San Diego continues to benefit from some of the strongest economic pillars in the country:

These deep, diversified anchors support a resilient CRE market even amid cyclical softening.

While Q3 reflects moderated demand across the board, San Diego’s extremely limited construction pipeline, land constraints, and high-cost entitlement environment continue to protect long-term values.

Investors: watching for repricing in retail and office

Owners: prioritize building quality and competitive pricing

Brokers: anticipate increased leasing activity in 2026 as space normalizes

San Diego remains a fundamentally strong market in the Southwest—one where stability, scarcity, and high barriers to entry continue to define long-term value.

Source: Costar

Ready to Take the Next Step?

Whether you’re buying, selling, leasing, or investing in San Diego commercial real estate, our expert advisors at SVN | Vanguard can help you navigate today’s market with clarity and confidence.

Commercial property ownership shouldn’t feel complicated. At SVN® Vanguard, we make it simple, strategic, and profitable. As a full-service commercial real estate firm, our Property Management Division delivers comprehensive solutions designed to protect and enhance your investment—so you can focus on what matters most: growing your portfolio.

SVN® Vanguard is part of a national network of SVN® Commercial Real Estate Advisors, connecting local expertise with global reach. Our professionals in San Diego, Orange County, and Los Angeles bring decades of experience managing office, industrial, retail, and multifamily properties across Southern California.

By combining property management, leasing, and capital markets expertise under one roof, we create ideal strategies keeping your assets performing at their best—no matter the market cycle.

“We treat every property as if it were our own, blending operational precision with genuine care for our clients and tenants.”

— SVN® Vanguard Property Management Team

Our Commercial Property Management Services are designed to take the stress out of ownership. From preventive maintenance and lease administration to tenant relations and collections, SVN® Vanguard ensures your property operates efficiently, compliantly, and profitably.

Our Core Services Include:

We adjust the management plan to the unique needs of each property, aligning with ownership goals and market conditions.

We believe in visibility and accountability. SVN® Vanguard leverages advanced management platforms that provide real-time tracking, financial reporting, and tenant communication tools—ensuring that owners always have a clear view of their property’s performance.

Our Property Management Division combines:

Whether you own a single building or a diverse portfolio, SVN® Vanguard provides the professional oversight and operational excellence that drive long-term success.

SVN® Vanguard is more than a management company — we’re your strategic partner in asset performance. Our commitment to transparency, collaboration, and client success sets us apart in the Southern California marketplace.

Ready to simplify your ownership experience?

Connect with our Property Management Division today to learn how we can help maximize your property’s potential.

Contact: management@svnvanguard.com

Visit: www.svnvanguardsdpm.com

Southern California is more than just a hotbed of sunshine and beaches—it is the epicenter of the U.S. self storage industry. A dozen of the 50 largest operators in the nation are headquartered here, with six based in Orange County alone, including Public Storage, the world’s largest self storage REIT (SpareFoot, 2024). This concentration of expertise, paired with the region’s dense population, high housing costs, and constrained development environment, makes understanding the total size of the market — in square footage — an essential step for investors and developers.

According to data from Storage Café, the Southern California self storage market includes:

| Metro Area | Facilities | Units | Total Square Feet |

| Los Angeles | 213 | 9,535 | 6.8M+ SF |

| San Diego | 83 | 10,388 | 6.6M+ SF |

| Inland Empire* | Data not fully disclosed | __ | Significant, growing rapidly |

The Inland Empire has become one of California’s fastest-expanding storage markets, fueled by migration from Los Angeles County, more attainable housing, and a development environment with fewer restrictions.

Combined, Los Angeles and San Diego alone account for over 13.4 million square feet of self storage space. Factoring in the Inland Empire, Orange County, and smaller Southern California markets would likely push the regional total well above 20 million square feet.

Smaller Living Spaces

California apartments average roughly 50 square feet smaller than the national norm, while households are larger at 2.8 people compared to 2.5 across the U.S. This density drives storage demand.

High Barriers to Entry

Limited buildable space in coastal metros constraints supply growth. Even with some new facilities entering the pipeline, such as the 6.62% projected supply increase in Los Angeles-Long Beach-Anaheim (Radius+, 2024), availability remains tight.

Headquarters Hub

Southern California’s role as the headquarters for many of the nation’s top storage operators creates an industry ecosystem that fosters expansion and innovation (SpareFoot, 2024).

The region is also a top performer in sales and pricing:

The California legislature is considering SB 709, which would cap annual self storage rent increases at 5% plus CPI (or 10%, whichever is lower). While supported by consumer advocates, the measure is opposed by industry groups, which argue it could limit operational flexibility (California Senate Judiciary Committee, 2025).

The self storage market in Southern California is vast, valuable, and strategically positioned for long-term growth. With more than 13.4 million square feet in Los Angeles and San Diego alone—and significant inventory in surrounding metros—the region offers one of the most compelling investment stories in the U.S. storage sector.

SVN | Vanguard specializes in identifying, evaluating, and transacting on self storage opportunities across Southern California, leveraging both national reach and deep local knowledge.

Are you interested in learning more? Contact us to request a full Southern California Self Storage Market Briefing!

Sources:

Radius+, California’s Top Growing Self Storage Markets (2024)

SpareFoot, Why Are So Many Self Storage Companies Based in Southern California? (2024)

Modern Storage Media, Q1 2025 Self Storage Sales at $855M Amid Positive Investor Sentiment

California Senate Judiciary Committee, SB 709: Self Service Storage Facilities

Welcome to the SVN Vanguard Self-Storage Team, your trusted experts in the acquisition and disposition of self-storage projects. Our team specializes in selling entitled, and Certificate of Occupancy (COO) projects located throughout California, delivering exceptional results with precision and expertise.

Joe Bonin: A seasoned professional with deep industry knowledge, Joe leads our team with strategic insight and a commitment to client success.

Daniel Bonin: Daniel brings sharp analytical skills and a client-focused approach, ensuring seamless transactions and optimal outcomes.

Pedro Ferreira: With extensive experience in project analysis and data management, Pedro drives efficiency and excellence in every transaction.

At SVN Vanguard, we focus on the sale and acquisition of:

Whether you’re looking to acquire or dispose of self-storage assets, our team is dedicated to guiding you through every step with professionalism and market expertise. Stay tuned for industry insights, project updates, and more from the SVN Vanguard Self-Storage Team!

The Southwest Region—spanning key markets like Phoenix, Denver, Las Vegas, and San Diego—continues to shift gears in 2025. Following years of rapid growth, the region is experiencing a recalibration. Industrial and retail remain steady, while multifamily faces supply challenges, and office continues to evolve. Throughout, investor sentiment is cautiously optimistic, with many watching for signs of bottoming in certain sectors.

San Diego Market Overview: Navigating Change in Q2

San Diego’s commercial real estate (CRE) market is adjusting to new realities. The second quarter of 2025 shows a city balancing rising vacancies in some sectors with encouraging momentum in others. Office space downtown continues to struggle, while industrial leasing picks up in trade-driven submarkets. Multifamily is navigating oversupply, and retail remains San Diego’s most stable and selective asset class.

Office Market: Downtown Vacancy Climbs, Suburbs Hold Ground

San Diego’s office market continues to face pressure. Citywide vacancy reached 13.1%, and Downtown surpassed 35%. New projects like the Campus at Horton and RaDD remain largely unleased, contributing to record-high availability. Real vacancy could be closer to 50% when factoring in unused and unlisted space.

Despite these challenges, suburban areas such as Del Mar Heights and Kearny Mesa are holding strong, with vacancies below 10%. Tenants are flocking to well-located, modern spaces, avoiding aging inventory downtown.

What This Means for You:

Industrial Market: Otay Mesa Leads Leasing Recovery

After over two years of negative net absorption, the industrial market is finding its footing. Vacancy stands at 9.5%, the highest since 2013, but leasing activity surged this quarter. Otay Mesa is the star performer, with proximity to the border driving strong logistics demand. Small-bay spaces under 50,000 SF remain in demand, especially in El Cajon, Escondido, and Central San Diego.

Flex industrial buildings tied to biotech are facing a slower recovery due to high sublet availability and tempered demand in Torrey Pines and Sorrento Valley.

What This Means for You:

Multifamily Market: High Supply, Flat Growth

Multifamily is in a holding pattern. Vacancy sits at 5.3% overall, but luxury apartments downtown and around Balboa Park are closer to 9%. Despite 4,700 units absorbed in the past year, generous concessions—6–8 weeks of free rent—are common. Rent growth is minimal at just 0.2% year-over-year.

A total of 9,200 units remain under construction, with several large projects due by 2026. High living costs and economic pressures are pushing renters toward more affordable or shared housing options.

What This Means for You:

Retail Market: Low Vacancy and High Selectivity

Retail is holding firm with a 4.4% vacancy rate and solid tenant demand. Service-based businesses and discount retailers are driving most of the leasing. Class A space in affluent areas like UTC, La Jolla, and Encinitas remains highly competitive.

Much of the available inventory is in older buildings or less affluent neighborhoods, where leasing has slowed. New retail development is minimal, with most new space tied to mixed-use projects.

What This Means for You:

Final Takeaways

Q2 2025 reveals a San Diego market that is adapting rather than retreating. Office continues to evolve with structural vacancy downtown. Industrial is rebounding, led by Otay Mesa. Multifamily remains under pressure but stable, and retail is steady, driven by lack of supply and selective tenant demand.

For investors, owners, and real estate professionals, success in today’s market hinges on adaptability, local knowledge, and a focus on submarket strengths. Keep watching, keep learning—opportunity lies in precision.

Ready to Take the Next Step?

Whether you’re buying, selling, leasing, or investing in San Diego commercial real estate, our expert advisors at SVN | Vanguard can help you navigate today’s market with clarity and confidence.

Source: Costar

The SVN Southwest Region Quarterly Newsletter will keep you informed and equipped with the latest trends, opportunities, and expert analysis in this thriving region. Our team of experienced professionals understands the dynamic nature of the Southwest’s commercial real estate landscape. We are committed to delivering valuable content, including market indicators, investment opportunities, regulatory updates, and localized insights.

The Southwest’s commercial real estate market is recalibrating after years of aggressive growth. Across major metros like Phoenix, San Diego, Denver, and Houston, developers are slowing down as elevated vacancies meet a more cautious tenant base. Industrial continues to be a standout—though vacancy has risen due to heavy deliveries in markets like Las Vegas and San Antonio, demand for small-bay and last-mile facilities remains solid. Otay Mesa in San Diego and West Phoenix are drawing serious interest from 3PLs and nearshoring occupiers despite macro headwinds like tariffs. Retail is proving remarkably resilient. Even with national closures, demand for quality space remains high—especially in high-income submarkets—fueling steady rent growth in San Diego, Phoenix, and Inland Empire.

Multifamily, meanwhile, faces its moment of digestion. A wave of new luxury units is colliding with affordability stress across markets, particularly in Phoenix (11.8% vacancy) and Las Vegas (9.6%). Concessions are widespread, and rent growth has turned negative in several metros. Still, absorption is healthy in markets like Fort Collins and San Diego, suggesting that demand exists—it just needs to catch up to supply. Office continues to struggle region-wide, with vacancy climbing past 16% in Phoenix and nearing record highs in Downtown San Diego. However, smaller, suburban spaces in places like Del Mar Heights and Chandler are still attracting tenants, reflecting a clear flight to quality and efficiency. Overall, Q1 signals not a market in freefall, but a sector in reset—clearing the runway for more strategic, sustainable growth ahead.

San Diego’s commercial real estate market in Q1 2025 presents varied conditions across the major property types—Office, Industrial, Multifamily, and Retail. This comprehensive review draws exclusively from CoStar’s detailed Q1 market reports to provide clarity and actionable insights for investors, property owners, brokers, and those new to commercial real estate.

As San Diego enters the second quarter of 2025, the commercial real estate (CRE) landscape reflects a bifurcated recovery. Some sectors are showing early signs of stabilization, while others struggle under the weight of high vacancies and economic stressors. Here’s a breakdown across the core sectors:

San Diego’s office market continues to face substantial headwinds, especially Downtown, where vacancies have reached unprecedented highs. The citywide vacancy rate stands at 12.9%, with Downtown alone facing a record-high availability above 35%, and industry insiders estimate true vacancy could be closer to 50%, factoring in unmarketed and underutilized space. Significant new developments like the completion of the 2.4M SF Campus at Horton and RaDD — with no tenants confirmed — intensifies the vacancy challenge.

The industrial market is experiencing mixed signals. Vacancy rates have climbed to 8.8%, a decade-high level driven by extensive new construction. The highest since 2013, due to 3.1M SF in new deliveries and over 2M SF in negative net absorption over the last 12 months. Otay Mesa is a bright spot, showcasing increased leasing activity driven by proximity to trade routes.

Multifamily properties are navigating a challenging environment characterized by substantial new unit deliveries, especially luxury units. Overall vacancy is stable at 5.0%, but submarkets like Downtown report vacancy rates exceeding 10%.

Retail remains relatively resilient with a 4.3% vacancy rate. Prime retail space remains scarce and in high demand, whereas older, lower-quality properties see longer vacancies.

San Diego’s commercial real estate landscape in early 2025 demands strategic adaptation. While office markets, especially Downtown, face structural challenges, industrial and retail sectors show selective strength, and multifamily grapples with high supply pressures.

Understanding these dynamics and responding strategically will be essential for success — whether you’re an investor, property owner, broker, or a newcomer.

Stay informed and proactive as the market continues to evolve.

Source: Costar

By SVN | Vanguard Commercial Real Estate Advisors, San Diego, CA

April 16, 2025

In this month’s economic update, we explore the shifting tides of small business sentiment, consumer behavior, real estate sectors, and employment data. Whether you’re an investor, developer, or just keeping a pulse on the market, here’s what you need to know to make informed, strategic decisions in Q2.

According to the National Federation of Independent Business (NFIB), small business optimism in March 2025 saw its sharpest monthly drop in nearly three years. Just 21% of business owners expect future conditions to improve, down significantly from February’s outlook. Only 3% anticipate increased sales in the short term.

Interestingly, the same business outlook components that surged following the November 2024 election have now reversed course, underscoring the volatile nature of political and economic sentiment.

What this means: Small businesses are approaching the next quarter cautiously. Expect scaled-back hiring, fewer expansion plans, and more risk-averse investment behavior across the board.

Morning Consult’s daily index shows consumer confidence experienced its second-largest three-day drop since the onset of the COVID-19 pandemic. After a post-election boost that carried into early 2025, consumer sentiment has been steadily declining.

While spending remained soft in February, forecasters anticipate a slight seasonal rebound due to the Easter holiday. Still, current trends suggest consumers are tightening their budgets in response to uncertainty around tariffs and broader inflation concerns.

The Logistics Managers’ Index (LMI) fell sharply from 62.8 in February to 57.1 in March, one of the steepest declines in its history. The drop is largely attributed to a cooldown in inventory costs, transportation prices, and warehouse demand—indicators that suggest the early-year rush to get ahead of tariffs has eased.

Although a reading above 50 still signals expansion, this downturn marks the shortest growth cycle in logistics in the past seven months.

Medical outpatient buildings (MOBs) are proving resilient in an otherwise cautious real estate environment. Asking rents increased 2.5% in 2024, and high-end properties led the way with stronger-than-average net operating income (NOI) growth.

With over 80% tenant retention rates and lease terms averaging nearly nine years, MOBs are drawing attention for their stability and long-term cash flow potential. Vacancy remains low at just 6.9%, further supporting investor confidence in this sector.

The National Multifamily Housing Council (NMHC) reports that 58% of developers are experiencing delays in Q1 2025—an improvement from the 78% figure at the end of 2024. Permitting remains the most common issue, followed by delays related to economic feasibility and professional services.

Geographically, the Southeast and Texas are facing more persistent slowdowns. While construction financing and labor shortages are improving, regulatory hurdles continue to test developer timelines.

The March jobs report from the Bureau of Labor Statistics delivered a surprise upside: 228,000 jobs were added, exceeding projections of 140,000. Healthcare and transportation led job growth, while the federal government continued trimming its workforce.

The unemployment rate ticked up slightly to 4.2%, but investor sentiment shifted toward a more dovish Federal Reserve stance. Markets are now forecasting a greater chance of multiple rate cuts by year-end.

Despite wavering confidence, the National Retail Federation predicts Easter 2025 spending will reach $23.6 billion, up from $22.4 billion in 2024. Discount stores are expected to capture the bulk of that spend, reinforcing the growing appeal of value-driven retail.

Egg prices, symbolic of seasonal inflation, have nearly doubled—yet Americans are still showing up to spend. Major retailers are optimistic, hoping to replicate December’s robust holiday sales performance.

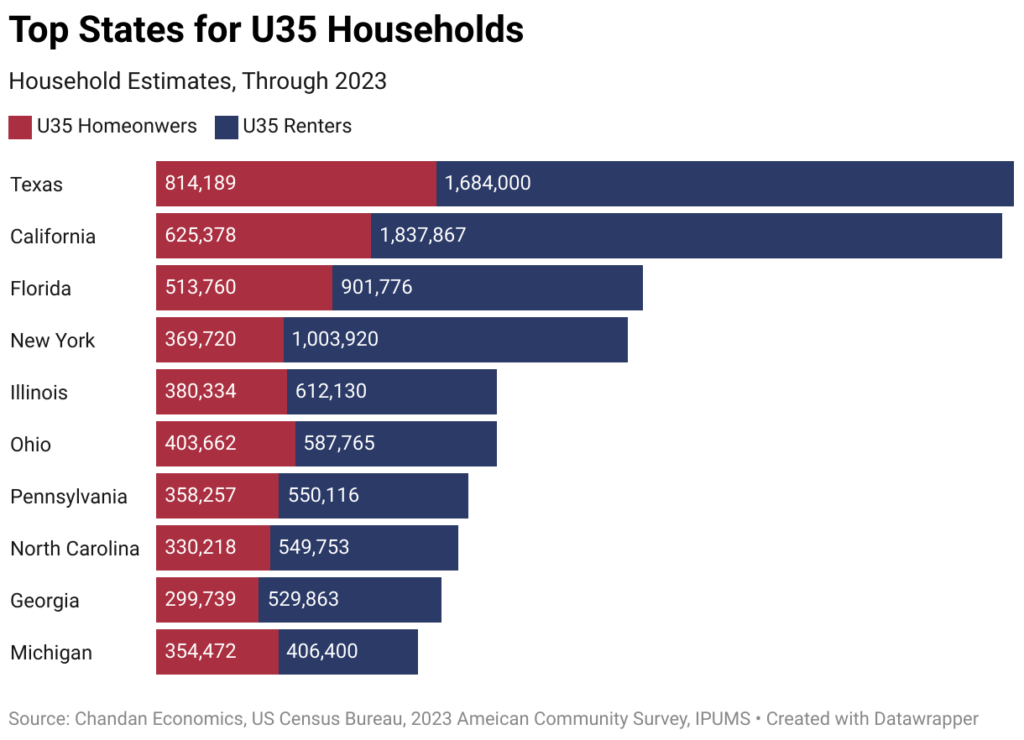

According to a recent analysis by Chandan Economics, Texas, California, and Florida lead the nation in the number of homeowners under age 35. However, when comparing under-35 homeowners as a percentage of all households, Utah, Alaska, and Iowa rank highest—signaling greater affordability.

In contrast, high-income states like California (4.6%), New York (4.8%), and Washington D.C. (3.5%) sit at the bottom, reflecting barriers to homeownership despite above-average wages.

The demand for work-from-home (WFH) rental units has dropped for the second consecutive year. There are now 4.0 million WFH rentals, down from a peak of 5.0 million in 2021. That’s a 20% decline over two years.

The market appears to be normalizing after the remote work surge of the pandemic. However, full-time remote workers are still 152% higher than pre-2020, suggesting long-term shifts remain in play.

The March Federal Open Market Committee (FOMC) meeting minutes reveal that the Fed chose to hold interest rates steady while assessing inflation and labor market signals. Policymakers acknowledged that inflation may run higher than expected due to new tariffs and supply chain pressures.

Most officials now see inflation risks as “tilted to the upside,” while risks to employment are growing on the downside.

While confidence may be shaky and geopolitical unknowns persist, not all sectors are retreating. Healthcare real estate, discount retail, and logistics remain areas of strength. In San Diego and beyond, this is a time to stay strategic—positioning ahead of rate cuts, leveraging tenant demand in core sectors, and anticipating changes in remote work trends.

Work Cited

SVN | Vanguard Commercial Real Estate Advisors.

Economic Update – April 10, 2025. SVN International Corp., 2025.

The 2025 SVN Annual Conference in San Antonio was an incredible experience, bringing together top commercial real estate professionals from across the country to collaborate, learn, and celebrate our shared success. Thanks to the SVN® International Corp. team for organizing an outstanding event filled with insightful speakers, networking opportunities, and industry-leading discussions.

Managing Directors: Pat Millay, Joe Bonin, & Cameron Irons

This year was especially momentous for SVN | Vanguard—after eight years of dedication and growth, we are proud to announce that we have been named the #1 SVN office in the United States! Out of more than 220+ offices nationwide, our team’s commitment to excellence, collaboration, and client success propelled us to the top.

Beyond our office’s success, we are thrilled to recognize the outstanding achievements of our top-performing Advisors.

Congratulations to our TEAM as well as the many other SVN | Vanguard Advisors who took home awards. Your hard work and dedication continue to set new standards in our industry.

Achieving the top ranking is a testament to the trust our clients place in us. At SVN | Vanguard, we don’t just close deals—we create long-term value for property owners, investors, and businesses across Southern California. Whether you’re looking to buy, sell, lease, or invest in commercial real estate, our team has the expertise, market knowledge, and nationwide network to help you achieve your goals.

Are you ready to work with the best? Contact SVN | Vanguard today and let’s discuss how we can maximize your real estate investments. Visit https://svnvanguard.com/ or call us at 619-442-9200 to get started.

Thank you again to SVN® International Corp. for an unforgettable conference, and congratulations to all the winners. Here’s to another year of growth, innovation, and success!

The start of 2025 brings a fresh perspective on the economic landscape. With the recent Economic Update, we can better understand trends shaping industries, from logistics and retail to real estate and labor. Let’s unpack the key highlights of this 2025 real estate forecast.

As December closed out the year, the Logistics Managers’ Index (LMI) dropped to a four-month low of 57.3, reflecting the expected seasonal inventory decline. However, upstream manufacturers ramped up imports to hedge against potential tariffs, leading to an unexpected inventory buildup. This strategic move was supported by a 15.6% year-over-year increase in U.S. imports from China. Meanwhile, transportation costs surged amid heightened holiday demand.

Takeaway: Despite short-term logistics slowdowns, strategic planning is keeping supply chains resilient.

While traditional indoor malls grapple with rising vacancies, open-air shopping centers are thriving, hitting a historic low vacancy rate of 6.2%. Despite the growth of e-commerce, physical stores accounted for 77% of 2024 holiday sales, highlighting their ongoing importance. Discount retailers are fueling this trend, with many planning expansions in 2025.

Takeaway: Open-air retail spaces are proving their staying power, creating investment opportunities in retail real estate.

3. Commercial Real Estate: Refinancing Takes Center Stage

Trepp’s 2024 analysis revealed a robust recovery in market liquidity, driven primarily by refinancing activity. With $96.83 billion in loans maturing by 2026, refinancing remains a safer bet for many property owners compared to sales. The private-label CMBS market saw an impressive 165% year-over-year growth, marking a strong rebound.

Takeaway: Refinancing trends underscore cautious optimism in commercial real estate markets.

Migration patterns reveal continued interest in the Carolinas, Texas, and Arizona, with Dallas and Charlotte leading as top destinations. U-Haul data shows a shift in inbound migration trends, indicating emerging hotspots beyond traditional movers’ hubs.

Takeaway: Population shifts are reshaping housing demand, retail activity, and local economies in these areas.

December’s Consumer Price Index (CPI) report showed signs of disinflation, with a 0.4% monthly and 2.9% annual increase. Core CPI slowed as well, offering a glimmer of relief. Stock markets responded positively, anticipating fewer rate hikes, but the Federal Reserve remains cautious about potential policy impacts.

Takeaway: Stabilizing inflation offers hope, but global economic uncertainties keep markets on edge.

The latest FOMC minutes reflect optimism about inflation trends moving toward the 2% target. Yet, concerns over labor market tightness and policy uncertainties persist, as the incoming administration’s tariff and immigration changes could shift economic dynamics.

Takeaway: Policymakers remain cautiously optimistic, emphasizing adaptability in the face of evolving conditions.

Capital Economics predicts modest GDP growth for major economies in 2025. China is expected to rebound, thanks to government interventions, while the U.S. may see minor inflationary pressures from proposed tariffs. A soft landing remains the central theme for the year.

Takeaway: While slower growth is anticipated, global markets appear resilient.

The U.S. added 256,000 jobs in December, exceeding expectations and nudging unemployment down to 4.1%. Wage growth remains steady at 3.9%, indicating a strong labor market. However, markets are recalibrating expectations for rate cuts in light of this resilience.

Takeaway: A robust labor market could anchor broader economic stability in 2025.

Although optimism dipped slightly in January, Americans remain generally positive about the economy, with the RealClearMarkets/TIPP index holding above 50. Concerns about trade policies and tariffs, however, are beginning to weigh on sentiment.

Takeaway: Confidence persists, but it’s fragile in the face of potential policy shifts.

Trepp reports a rise in special servicing rates for mixed-use and multifamily properties, with mixed-use loans hitting their highest rate since 2013. On the flip side, industrial real estate continues to perform well, with minimal special servicing rates.

Takeaway: The divergence between property types underscores the importance of strategic sector focus in real estate investments.

Final Thoughts The January 2025 Economic Update highlights a dynamic economic environment marked by resilience and strategic adaptation. While inflation cools and logistics recalibrate, strong job growth and retail demand signal robust underpinnings. For investors, business owners, and policymakers, the year ahead presents opportunities to navigate change with confidence.

What’s your take on these economic shifts? Share your thoughts below or reach out to discuss how these trends might impact your industry!

Southwest Region: 2024 Q2 Insights from SVN’s Regional Experts

If you’re wondering where the smart money is heading in commercial real estate, look no further than the Southwest Region. From the tech boom in San Diego to the resurgence of Las Vegas, and Denver’s growth spurt to the ever-evolving Los Angeles landscape, this region is buzzing with opportunity. But with so much happening, how do you separate the hype from the real deals?

That’s where our SVN Southwest Region team comes in. With boots on the ground in every key city—San Diego, Denver, Las Vegas, Los Angeles, Orange County, Inland Empire, Phoenix, Fort Collins, Albuquerque, Dallas Fort Worth, and Houston —we don’t just watch the market; we live it. Our local experts are quick in catching the latest trends, shifts, and opportunities before they hit the headlines. So, whether you’re an investor, developer, or just a real estate enthusiast, grab a cup of coffee (or maybe something stronger) and let’s dive into what’s happening right now in the Southwest Region commercial real estate market.

The Southwest Region: A Powerhouse of Diverse Real Estate Markets

Los Angeles and Orange County lead the way with their robust economies driven by tech, entertainment, and a resilient industrial sector. The tech and biotech industries continue to fuel growth in San Diego, while the Inland Empire keeps it position as a key logistics and distribution hub, powered by e-commerce. Meanwhile, Las Vegas is redefining itself beyond tourism and becoming a major player for innovation, logistics, and entertainment.

Heading east, we have Phoenix and Denver who are emerging as the top-tier choices for businesses and residents alike, thank to their competitive costs, lifestyle appeal, and growing job markets. Fort Collins, known for its high quality of life and emerging tech sector, complements the Denver market, while Albuquerque offer affordability and growth potential in market that is often overlooked.

Dallas-Fort Worth and Houston are both experiencing rapid growth, with DFW’s thriving corporate relocations and tech startups, while Houston has its diversified economy and its strong industrial / office demand.

As these cities continue to evolve, the Southwest Region presents an abundance of opportunities with each market offering a unique dynamic and potential for growth. It’s a region where staying ahead means staying informed , and any of our SVN® teams are here to provide you with the best advice and market information you need to navigate the commercial real estate world.