The SVN Southwest Region Quarterly Newsletter will keep you informed and equipped with the latest trends, opportunities, and expert analysis in this thriving region. Our team of experienced professionals understands the dynamic nature of the Southwest’s commercial real estate landscape. We are committed to delivering valuable content, including market indicators, investment opportunities, regulatory updates, and localized insights.

The Southwest’s commercial real estate market is recalibrating after years of aggressive growth. Across major metros like Phoenix, San Diego, Denver, and Houston, developers are slowing down as elevated vacancies meet a more cautious tenant base. Industrial continues to be a standout—though vacancy has risen due to heavy deliveries in markets like Las Vegas and San Antonio, demand for small-bay and last-mile facilities remains solid. Otay Mesa in San Diego and West Phoenix are drawing serious interest from 3PLs and nearshoring occupiers despite macro headwinds like tariffs. Retail is proving remarkably resilient. Even with national closures, demand for quality space remains high—especially in high-income submarkets—fueling steady rent growth in San Diego, Phoenix, and Inland Empire.

Multifamily, meanwhile, faces its moment of digestion. A wave of new luxury units is colliding with affordability stress across markets, particularly in Phoenix (11.8% vacancy) and Las Vegas (9.6%). Concessions are widespread, and rent growth has turned negative in several metros. Still, absorption is healthy in markets like Fort Collins and San Diego, suggesting that demand exists—it just needs to catch up to supply. Office continues to struggle region-wide, with vacancy climbing past 16% in Phoenix and nearing record highs in Downtown San Diego. However, smaller, suburban spaces in places like Del Mar Heights and Chandler are still attracting tenants, reflecting a clear flight to quality and efficiency. Overall, Q1 signals not a market in freefall, but a sector in reset—clearing the runway for more strategic, sustainable growth ahead.

San Diego’s commercial real estate market in Q1 2025 presents varied conditions across the major property types—Office, Industrial, Multifamily, and Retail. This comprehensive review draws exclusively from CoStar’s detailed Q1 market reports to provide clarity and actionable insights for investors, property owners, brokers, and those new to commercial real estate.

As San Diego enters the second quarter of 2025, the commercial real estate (CRE) landscape reflects a bifurcated recovery. Some sectors are showing early signs of stabilization, while others struggle under the weight of high vacancies and economic stressors. Here’s a breakdown across the core sectors:

San Diego’s office market continues to face substantial headwinds, especially Downtown, where vacancies have reached unprecedented highs. The citywide vacancy rate stands at 12.9%, with Downtown alone facing a record-high availability above 35%, and industry insiders estimate true vacancy could be closer to 50%, factoring in unmarketed and underutilized space. Significant new developments like the completion of the 2.4M SF Campus at Horton and RaDD — with no tenants confirmed — intensifies the vacancy challenge.

The industrial market is experiencing mixed signals. Vacancy rates have climbed to 8.8%, a decade-high level driven by extensive new construction. The highest since 2013, due to 3.1M SF in new deliveries and over 2M SF in negative net absorption over the last 12 months. Otay Mesa is a bright spot, showcasing increased leasing activity driven by proximity to trade routes.

Multifamily properties are navigating a challenging environment characterized by substantial new unit deliveries, especially luxury units. Overall vacancy is stable at 5.0%, but submarkets like Downtown report vacancy rates exceeding 10%.

Retail remains relatively resilient with a 4.3% vacancy rate. Prime retail space remains scarce and in high demand, whereas older, lower-quality properties see longer vacancies.

San Diego’s commercial real estate landscape in early 2025 demands strategic adaptation. While office markets, especially Downtown, face structural challenges, industrial and retail sectors show selective strength, and multifamily grapples with high supply pressures.

Understanding these dynamics and responding strategically will be essential for success — whether you’re an investor, property owner, broker, or a newcomer.

Stay informed and proactive as the market continues to evolve.

Source: Costar

By SVN | Vanguard Commercial Real Estate Advisors, San Diego, CA

April 16, 2025

In this month’s economic update, we explore the shifting tides of small business sentiment, consumer behavior, real estate sectors, and employment data. Whether you’re an investor, developer, or just keeping a pulse on the market, here’s what you need to know to make informed, strategic decisions in Q2.

According to the National Federation of Independent Business (NFIB), small business optimism in March 2025 saw its sharpest monthly drop in nearly three years. Just 21% of business owners expect future conditions to improve, down significantly from February’s outlook. Only 3% anticipate increased sales in the short term.

Interestingly, the same business outlook components that surged following the November 2024 election have now reversed course, underscoring the volatile nature of political and economic sentiment.

What this means: Small businesses are approaching the next quarter cautiously. Expect scaled-back hiring, fewer expansion plans, and more risk-averse investment behavior across the board.

Morning Consult’s daily index shows consumer confidence experienced its second-largest three-day drop since the onset of the COVID-19 pandemic. After a post-election boost that carried into early 2025, consumer sentiment has been steadily declining.

While spending remained soft in February, forecasters anticipate a slight seasonal rebound due to the Easter holiday. Still, current trends suggest consumers are tightening their budgets in response to uncertainty around tariffs and broader inflation concerns.

The Logistics Managers’ Index (LMI) fell sharply from 62.8 in February to 57.1 in March, one of the steepest declines in its history. The drop is largely attributed to a cooldown in inventory costs, transportation prices, and warehouse demand—indicators that suggest the early-year rush to get ahead of tariffs has eased.

Although a reading above 50 still signals expansion, this downturn marks the shortest growth cycle in logistics in the past seven months.

Medical outpatient buildings (MOBs) are proving resilient in an otherwise cautious real estate environment. Asking rents increased 2.5% in 2024, and high-end properties led the way with stronger-than-average net operating income (NOI) growth.

With over 80% tenant retention rates and lease terms averaging nearly nine years, MOBs are drawing attention for their stability and long-term cash flow potential. Vacancy remains low at just 6.9%, further supporting investor confidence in this sector.

The National Multifamily Housing Council (NMHC) reports that 58% of developers are experiencing delays in Q1 2025—an improvement from the 78% figure at the end of 2024. Permitting remains the most common issue, followed by delays related to economic feasibility and professional services.

Geographically, the Southeast and Texas are facing more persistent slowdowns. While construction financing and labor shortages are improving, regulatory hurdles continue to test developer timelines.

The March jobs report from the Bureau of Labor Statistics delivered a surprise upside: 228,000 jobs were added, exceeding projections of 140,000. Healthcare and transportation led job growth, while the federal government continued trimming its workforce.

The unemployment rate ticked up slightly to 4.2%, but investor sentiment shifted toward a more dovish Federal Reserve stance. Markets are now forecasting a greater chance of multiple rate cuts by year-end.

Despite wavering confidence, the National Retail Federation predicts Easter 2025 spending will reach $23.6 billion, up from $22.4 billion in 2024. Discount stores are expected to capture the bulk of that spend, reinforcing the growing appeal of value-driven retail.

Egg prices, symbolic of seasonal inflation, have nearly doubled—yet Americans are still showing up to spend. Major retailers are optimistic, hoping to replicate December’s robust holiday sales performance.

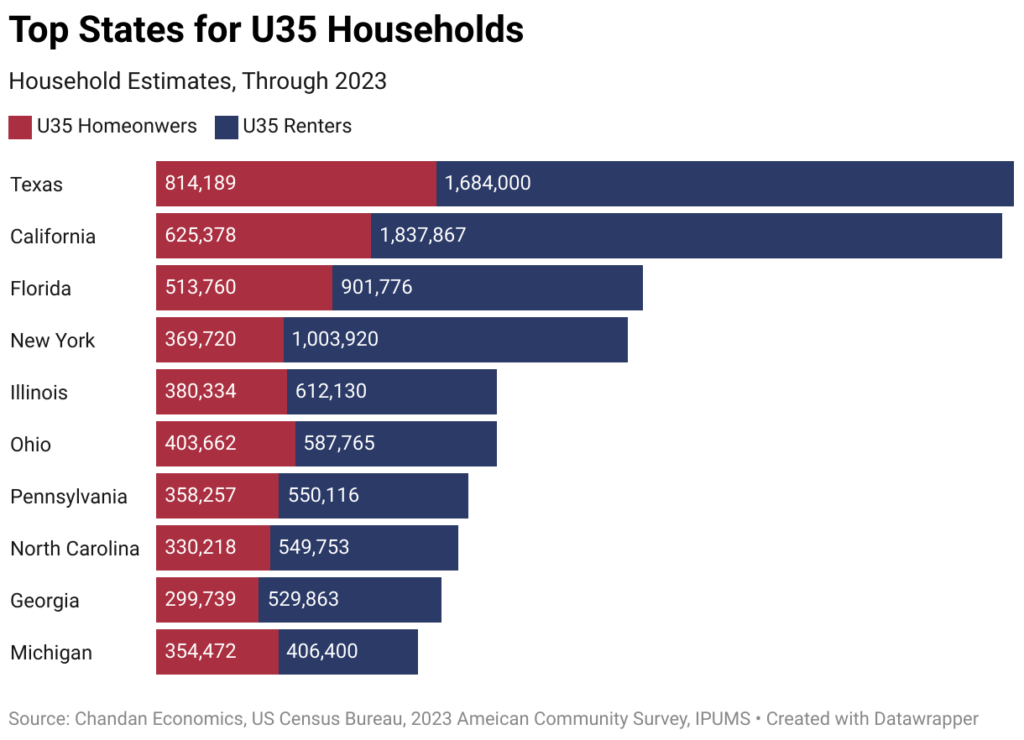

According to a recent analysis by Chandan Economics, Texas, California, and Florida lead the nation in the number of homeowners under age 35. However, when comparing under-35 homeowners as a percentage of all households, Utah, Alaska, and Iowa rank highest—signaling greater affordability.

In contrast, high-income states like California (4.6%), New York (4.8%), and Washington D.C. (3.5%) sit at the bottom, reflecting barriers to homeownership despite above-average wages.

The demand for work-from-home (WFH) rental units has dropped for the second consecutive year. There are now 4.0 million WFH rentals, down from a peak of 5.0 million in 2021. That’s a 20% decline over two years.

The market appears to be normalizing after the remote work surge of the pandemic. However, full-time remote workers are still 152% higher than pre-2020, suggesting long-term shifts remain in play.

The March Federal Open Market Committee (FOMC) meeting minutes reveal that the Fed chose to hold interest rates steady while assessing inflation and labor market signals. Policymakers acknowledged that inflation may run higher than expected due to new tariffs and supply chain pressures.

Most officials now see inflation risks as “tilted to the upside,” while risks to employment are growing on the downside.

While confidence may be shaky and geopolitical unknowns persist, not all sectors are retreating. Healthcare real estate, discount retail, and logistics remain areas of strength. In San Diego and beyond, this is a time to stay strategic—positioning ahead of rate cuts, leveraging tenant demand in core sectors, and anticipating changes in remote work trends.

Work Cited

SVN | Vanguard Commercial Real Estate Advisors.

Economic Update – April 10, 2025. SVN International Corp., 2025.

The 2025 SVN Annual Conference in San Antonio was an incredible experience, bringing together top commercial real estate professionals from across the country to collaborate, learn, and celebrate our shared success. Thanks to the SVN® International Corp. team for organizing an outstanding event filled with insightful speakers, networking opportunities, and industry-leading discussions.

Managing Directors: Pat Millay, Joe Bonin, & Cameron Irons

This year was especially momentous for SVN | Vanguard—after eight years of dedication and growth, we are proud to announce that we have been named the #1 SVN office in the United States! Out of more than 220+ offices nationwide, our team’s commitment to excellence, collaboration, and client success propelled us to the top.

Beyond our office’s success, we are thrilled to recognize the outstanding achievements of our top-performing Advisors.

Congratulations to our TEAM as well as the many other SVN | Vanguard Advisors who took home awards. Your hard work and dedication continue to set new standards in our industry.

Achieving the top ranking is a testament to the trust our clients place in us. At SVN | Vanguard, we don’t just close deals—we create long-term value for property owners, investors, and businesses across Southern California. Whether you’re looking to buy, sell, lease, or invest in commercial real estate, our team has the expertise, market knowledge, and nationwide network to help you achieve your goals.

Are you ready to work with the best? Contact SVN | Vanguard today and let’s discuss how we can maximize your real estate investments. Visit https://svnvanguard.com/ or call us at 619-442-9200 to get started.

Thank you again to SVN® International Corp. for an unforgettable conference, and congratulations to all the winners. Here’s to another year of growth, innovation, and success!

The start of 2025 brings a fresh perspective on the economic landscape. With the recent Economic Update, we can better understand trends shaping industries, from logistics and retail to real estate and labor. Let’s unpack the key highlights of this 2025 real estate forecast.

As December closed out the year, the Logistics Managers’ Index (LMI) dropped to a four-month low of 57.3, reflecting the expected seasonal inventory decline. However, upstream manufacturers ramped up imports to hedge against potential tariffs, leading to an unexpected inventory buildup. This strategic move was supported by a 15.6% year-over-year increase in U.S. imports from China. Meanwhile, transportation costs surged amid heightened holiday demand.

Takeaway: Despite short-term logistics slowdowns, strategic planning is keeping supply chains resilient.

While traditional indoor malls grapple with rising vacancies, open-air shopping centers are thriving, hitting a historic low vacancy rate of 6.2%. Despite the growth of e-commerce, physical stores accounted for 77% of 2024 holiday sales, highlighting their ongoing importance. Discount retailers are fueling this trend, with many planning expansions in 2025.

Takeaway: Open-air retail spaces are proving their staying power, creating investment opportunities in retail real estate.

3. Commercial Real Estate: Refinancing Takes Center Stage

Trepp’s 2024 analysis revealed a robust recovery in market liquidity, driven primarily by refinancing activity. With $96.83 billion in loans maturing by 2026, refinancing remains a safer bet for many property owners compared to sales. The private-label CMBS market saw an impressive 165% year-over-year growth, marking a strong rebound.

Takeaway: Refinancing trends underscore cautious optimism in commercial real estate markets.

Migration patterns reveal continued interest in the Carolinas, Texas, and Arizona, with Dallas and Charlotte leading as top destinations. U-Haul data shows a shift in inbound migration trends, indicating emerging hotspots beyond traditional movers’ hubs.

Takeaway: Population shifts are reshaping housing demand, retail activity, and local economies in these areas.

December’s Consumer Price Index (CPI) report showed signs of disinflation, with a 0.4% monthly and 2.9% annual increase. Core CPI slowed as well, offering a glimmer of relief. Stock markets responded positively, anticipating fewer rate hikes, but the Federal Reserve remains cautious about potential policy impacts.

Takeaway: Stabilizing inflation offers hope, but global economic uncertainties keep markets on edge.

The latest FOMC minutes reflect optimism about inflation trends moving toward the 2% target. Yet, concerns over labor market tightness and policy uncertainties persist, as the incoming administration’s tariff and immigration changes could shift economic dynamics.

Takeaway: Policymakers remain cautiously optimistic, emphasizing adaptability in the face of evolving conditions.

Capital Economics predicts modest GDP growth for major economies in 2025. China is expected to rebound, thanks to government interventions, while the U.S. may see minor inflationary pressures from proposed tariffs. A soft landing remains the central theme for the year.

Takeaway: While slower growth is anticipated, global markets appear resilient.

The U.S. added 256,000 jobs in December, exceeding expectations and nudging unemployment down to 4.1%. Wage growth remains steady at 3.9%, indicating a strong labor market. However, markets are recalibrating expectations for rate cuts in light of this resilience.

Takeaway: A robust labor market could anchor broader economic stability in 2025.

Although optimism dipped slightly in January, Americans remain generally positive about the economy, with the RealClearMarkets/TIPP index holding above 50. Concerns about trade policies and tariffs, however, are beginning to weigh on sentiment.

Takeaway: Confidence persists, but it’s fragile in the face of potential policy shifts.

Trepp reports a rise in special servicing rates for mixed-use and multifamily properties, with mixed-use loans hitting their highest rate since 2013. On the flip side, industrial real estate continues to perform well, with minimal special servicing rates.

Takeaway: The divergence between property types underscores the importance of strategic sector focus in real estate investments.

Final Thoughts The January 2025 Economic Update highlights a dynamic economic environment marked by resilience and strategic adaptation. While inflation cools and logistics recalibrate, strong job growth and retail demand signal robust underpinnings. For investors, business owners, and policymakers, the year ahead presents opportunities to navigate change with confidence.

What’s your take on these economic shifts? Share your thoughts below or reach out to discuss how these trends might impact your industry!

Southwest Region: 2024 Q2 Insights from SVN’s Regional Experts

If you’re wondering where the smart money is heading in commercial real estate, look no further than the Southwest Region. From the tech boom in San Diego to the resurgence of Las Vegas, and Denver’s growth spurt to the ever-evolving Los Angeles landscape, this region is buzzing with opportunity. But with so much happening, how do you separate the hype from the real deals?

That’s where our SVN Southwest Region team comes in. With boots on the ground in every key city—San Diego, Denver, Las Vegas, Los Angeles, Orange County, Inland Empire, Phoenix, Fort Collins, Albuquerque, Dallas Fort Worth, and Houston —we don’t just watch the market; we live it. Our local experts are quick in catching the latest trends, shifts, and opportunities before they hit the headlines. So, whether you’re an investor, developer, or just a real estate enthusiast, grab a cup of coffee (or maybe something stronger) and let’s dive into what’s happening right now in the Southwest Region commercial real estate market.

The Southwest Region: A Powerhouse of Diverse Real Estate Markets

Los Angeles and Orange County lead the way with their robust economies driven by tech, entertainment, and a resilient industrial sector. The tech and biotech industries continue to fuel growth in San Diego, while the Inland Empire keeps it position as a key logistics and distribution hub, powered by e-commerce. Meanwhile, Las Vegas is redefining itself beyond tourism and becoming a major player for innovation, logistics, and entertainment.

Heading east, we have Phoenix and Denver who are emerging as the top-tier choices for businesses and residents alike, thank to their competitive costs, lifestyle appeal, and growing job markets. Fort Collins, known for its high quality of life and emerging tech sector, complements the Denver market, while Albuquerque offer affordability and growth potential in market that is often overlooked.

Dallas-Fort Worth and Houston are both experiencing rapid growth, with DFW’s thriving corporate relocations and tech startups, while Houston has its diversified economy and its strong industrial / office demand.

As these cities continue to evolve, the Southwest Region presents an abundance of opportunities with each market offering a unique dynamic and potential for growth. It’s a region where staying ahead means staying informed , and any of our SVN® teams are here to provide you with the best advice and market information you need to navigate the commercial real estate world.

June 26, 2024 – 2024 Southwest Region Meeting – Del Mar Races

The SVN Vanguard Southwest Region Conference delivered a day filled with valuable insights, networking opportunities, and a deep dive into the latest trends and developments in the commercial real estate industry. Here’s the breakdown of emerging topics covered throughout the conference.

Breakfast by Rise Southern Biscuits and Righteous Chicken

The day kicked off with a delicious breakfast courtesy of Rise Southern Biscuits and Righteous Chicken. This gave our SVN advisors the perfect opportunity to get to know each other and network within SVN’s Southwest Region circle.

This was a key part of the day because it opened up the opportunity for brokers to team up with others and close deals across state lines to utilize our national network in the future.

A special thanks to all the SVN branches who made it out to San Diego:

Joe Bonin, Managing Director, San Diego led the opening remarks, introducing the other SVN Managing Directors and setting the stage for the day’s events, providing an overview of the conference’s objectives and the value it offers to its attendees.

Managing Directors:

Joe Bonin on QSR Business Automation

The first conversation consisted of Joe Bonin (Managing Director, SVN San Diego) explaining the importance and intricacies of Quick Service Restaurants (QSRs) and how their pivoting business model can have a future impact on the employment industry.

The main QSR discussed during this conversation was about the quick rise to popularity of Rise Southern Biscuits and Righteous Chicken. If you haven’t tasted it, we suggest you do! Ever since 2020, the restaurant scene has been ever changing and Rise is ahead of the curve on this drastic change. By implementing technology to streamline the ordering and pickup process for customers, Rise has been able to severely cut down operational costs and increase profitability of their restaurant.

By having customers simply order through Rise’s app, they are able to cut down waiting times substantially and collect valuable marketing information that can be implemented into their advertising systems and automations for each individual customer. Will QSR’s become the new norm within the service industry due to their low cost of operation and lower liability risks?

What do you think? Are QSRs the future?

Ryan Ward on How to Set Up Buildout Grids

The next speaker was Ryan Ward, a seasoned Senior Advisor for SVN Vanguard and a well-respected multifamily broker within the San Diego market. Ryan provided valuable insights into the challenges advisors face in the multifamily industry, particularly highlighting the complexities involved in evaluating and underwriting multifamily properties.

Ryan emphasized the shift away from traditional methods, such as meticulously crafted Excel sheets, which have long been the standard for property valuation. He introduced a new, innovative approach on Buildout’s platform that streamlines the evaluation process, making it more efficient and accurate, while having the ability to implement real-time numbers your client might suggest. Ryan’s method leverages advanced technology and data analytics to assess the value of properties, providing a more comprehensive and nuanced understanding of the market.

By adopting this new methodology, advisors can now evaluate properties with greater precision and confidence, considering factors that might have been overlooked in the past. This approach not only saves time but also enhances the accuracy of valuations, ultimately benefiting both advisors and their clients. Ryan’s presentation underscored the importance of embracing modern tools and techniques in a rapidly evolving industry, paving the way for more informed decision-making and better client outcomes.

Patrick Millay on the Impact of Insurance Changes to Both Tenants and Landlords

Patrick discussed the recent changes in insurance policies and the implications for both tenants and landlords. This conversation explored how these changes could affect businesses and how SVN can offer strategies to navigate the evolving insurance landscape.

One of the key highlights of Patrick’s presentation was the introduction of SVN Vanguard’s Master Insurance Program. This innovative program is designed to assist brokers within the Southwest Region in providing substantial cost-saving solutions to business and property owners. By consolidating vetted property owners into a portfolio of assets, the Master Insurance Program enables these owners to benefit from reduced insurance costs.

The program works by leveraging the collective strength of multiple properties, allowing participants to access more favorable insurance rates and terms that might not be available to individual property owners. This not only helps lower the overall insurance expenses but also offers comprehensive coverage tailored to the specific needs of the included properties.

This program represents a significant opportunity for our Advisors to pitch SVN Vanguard’s services (property management and brokerage) to potential clients, positioning the firm as a valuable partner in managing and optimizing insurance costs. The Master Insurance Program exemplifies SVN Vanguard’s commitment to providing innovative and practical solutions supporting the financial well-being of their clients.

Product Breakout Session

Attendees participated in four breakout groups, each focused on a different asset type: Office, Retail, Industrial, and Multifamily. These breakout sessions provided a platform for in-depth discussions about the unique challenges and opportunities associated with each asset class across various markets, including San Diego, Las Vegas, Phoenix, and Orange County.

Across all breakout groups, there was a shared understanding of the importance of adapting to market changes and leveraging local market knowledge to capitalize on opportunities. The sessions provided valuable insights and actionable strategies for participants to apply within their own markets, reinforcing SVN Vanguard’s commitment to fostering collaboration and innovation in the commercial real estate industry.

“SVN Vanguard is pleased to announce the opening of the Nativity Prep Academy STEM center and Commercial Kitchen. SVN Vanguard has been responsible for the initial school site acquisition, project design, project management, tech, and landscape. SVN Vanguard was also responsible for the space layout, interior design, and tech buildout of the STEM. Congratulations to Nativity Prep!!!“

– Joe Bonin, Managing Director

At SVN Vanguard, we believe in the power of community and the importance of education. Our commitment to these values is exemplified by our Managing Director, Joe Bonin, whose dedication extends beyond the boardroom and into the heart of San Diego. Joe has been actively involved in supporting Nativity Prep Academy, a Catholic middle school. Located at 4463 College Ave, San Diego, CA 92115.

This year, Nativity Prep Academy has taken a monumental step in advancing educational opportunities with the inauguration of a state-of-the-art STEM Center. This innovative facility offers a cutting-edge learning environment designed to inspire and equip students with the skills needed for the future.

The STEM Center boasts a variety of specialized spaces:

STEM workers drive our nation’s innovation and competitiveness with the creation of new ideas, new companies, and new industries. However, children from underserved communities, particularly girls and students of color, are vastly underrepresented in the STEM industry. Providing our students with opportunities to pursue — and thrive in STEM careers will help to create social mobility, enhance economic security, and ensure a diverse and talented STEM workforce.

We envision our programs building a pipeline for future employees and entrepreneurs in STEM fields and invite you to partner with us to make this a success. Designed as an early-intervention program, we aim to introduce STEM concepts to middle school students, enabling them to continue their learning in STEM fields throughout high school and college.

The curriculum at the STEM Center is not only focused on academic excellence but also on career exploration, helping students to envision and work towards their future careers. With the addition of more classroom space, Nativity Prep Academy can now welcome even more students into its programs, providing them with the resources and support they need to succeed.

The new STEM Center also introduces sustainable revenue streams to support the Academy’s annual operating budget. By renting out the kitchen, labs, and classrooms, Nativity Prep ensures a steady flow of income to maintain and enhance its educational offerings. The upgraded kitchen facilities will significantly improve daily nutrition services for students, ensuring they have the energy and focus needed for their studies.

Furthermore, the enhanced parent education program will provide valuable resources and support to families, fostering a stronger community bond. The shared STEM programming opportunities extend beyond the school, supporting the local community and nurturing a culture of learning and innovation.

At SVN Vanguard, we are incredibly proud of Joe Bonin’s involvement with Nativity Prep Academy. His dedication to supporting educational initiatives aligns with our company’s values and our commitment to making a positive impact in the communities we serve. The new STEM Center is not just a facility; it is a beacon of opportunity, empowering students and enriching our community.

Join us in celebrating this remarkable achievement and supporting the future leaders of our community. To learn more about Nativity Prep Academy and how you can get involved, visit their website or view our non-profit real estate page. Let’s cultivate curiosity together and build a brighter future.

NBC San Diego:

https://www.nbcsandiego.com/videos/nativity-prep-academy-gets-new-stem-center/3527180

SVN Vanguard finished #1 in the region and #3 nationally in this year’s SVN National conference in Miami, FL. Following a successful 2022 campaign as the international firm of the year, SVN Vanguard continues to deliver top tier performance for 2023.

In addition, the San Diego County Vista Chamber of Commerce named the SVN | Vanguard North County Office the New Business of the Year.

To compile rankings for SVN’s national conference, SVN International Corp. identifies the top producing brokerages and advisors based upon closed commercial real estate transactions. Top producing Advisors are ranked in three different categories based on their gross commission income (GCI). The categories are: Partner’s Circle, President’s Circle and Achiever Award. Tony Yousif, Director- National Accounts, achieved Partner’s Circle status as one of the top advisors in the SVN network. Cameron Irons, Executive Director at SVN Vanguard, and Senior Vice President, Jon Davis, were also recognized for ranking within the Top 100 Advisors of 2023.

About SVN Vanguard

SVN Vanguard is a full-service commercial real estate office of the SVN brand, comprising over 1,600 commercial real estate Advisors and staff, in more offices in the United States than any other commercial real estate firm and continues to expand across the globe. We believe geographical coverage and amplified outreach to traditional, cross-market and emerging buyers and tenants is the only way to achieve maximum value to our clients.

Inflation, uncertainty, tightening, recession — these are just a few of the many terms thrown around in recent months, placing investor pessimism on display. However, the economy is sending mixed signals about its health. Let’s look at the state of the commercial real estate market for 2023.

While several large and attention-generating companies have recently completed or announced rounds of layoffs, nationwide job growth continues to be relatively impressive. According to the Bureau of Labor Statistics, the US economy added 311,000 jobs in February, falling from a January tally of 504,000 but far from labor market loosening.

Unemployment claims have jumped to begin March after falling to a nine-month low in January, but job openings remain robust, with more than 10.8 million open positions across the country.

However, investor jitters aren’t without merit. Over the past several weeks, a complex web of economic data, business news, and policymaker statements have only blurred the outlook further.

Let’s start with inflation. The post-pandemic inflation saga has now stretched into its third calendar year, and while there are signs that price growth is slowing, policymakers will be keen on preventing embers from reigniting the flame.

After peaking at a generational high of 8.9% in June of last year, the Consumer Price Index (CPI) has improved for seven straight months, declining to a 6.0% annual inflation rate in February. Still, even if monthly inflation remained flat (0%) through the next six months, annual inflation would still be above the Fed’s 2% target.

Despite rising uncertainty, early 2023 data suggests that at least some of last year’s momentum is carrying into the new year, dampening the likelihood that we are already in recession. Still, policymakers at the Federal Reserve are warning that more good news about the economy may be increasing the risk of a hard landing. As the US economy charges forward, it risks placing further upward pressure on prices, backing the Fed into a corner where higher rates are their only tactical option.

Minutes from the FOMC’s January policy meeting alongside a March 7th speech by Fed Chair Jerome Powell reflected the committee’s willingness to again “increase the pace” of rate-hikes if, in Powell’s words, the “totality of the data were to indicate” such was needed. Fed officials’ increasingly hawkish sentiment has reinforced the consensus that policymakers will be going the distance on fighting inflation, even if markets sit in the crosshairs.

However, a new development may throw water on theFed’s plans. On March 10th and in the days since, the collapse of Silicon Valley Bank and Signature Bank became the largest US bank failures since the 2008 financial crisis — primarily due to a lapse in strategy for today’s rising interest-rate environment. While regulators have stepped in and given public assurances to help affirm faith in the financial system, the market is betting the SVB failure forces Jerome Powell and company to pivot their monetary policy.

According to the Chicago Mercantile Exchange’s Fed Watch Tool, futures markets are pricing in a 58.3% chance of a 25-basis point hike in March and a 41.7% chance that the committee will hold rates constant at 450-475 (as of the morning of March 13th, 2023).

For context, just a few weeks ago, an overwhelming majority (90.8%) of futures traders projected a 25-basis point rate increase in March, driven toward consensus by improving inflation metrics and a gradual reduction in the Fed’s recent rate hikes. The consensus then shifted to forecasting a 50-basis point hike following Powell’s hawkish March 7th press conference — only to move back to 25 bps following the SVB failure.

Overall, the state of the US economy in 2023 is, well…complicated. And we didn’t even mention Washington’s ongoing debt ceiling dilemma. As investors look through their windshields, factoring in this increased uncertainty will be necessary. Receding market panic from the SVB/Signature collapse alongside inflation’s tepid deceleration in February increases the likelihood that policymakers will raise rates by at least a 25 basis points later this month. If the above assumption holds, the development should provide markets with a better sense of direction moving forward and reduce short-term uncertainty.

This new office in North County San Diego will be an addition to the SVN Vanguard offices in San Diego, Santa Ana, Long Beach, Los Angeles.

SVN Vanguard is an independently owned company that is part of the 200+ companies in the SVN global network. SVN Vanguard is one of largest companies in the SVN system and is currently ranked #3 globally.

SVN Vanguard offers commercial real estate sales and leasing, property management and maintenance services. Joe Bonin will be the North County office Managing Director and Tony Ying will provide Regional Manager support.

“SVN Vista is now officially open. Servicing commercial real estate in North County San Diego including San Marcos, Escondido, Encinitas & Poway”

The SVN Vanguard Vista location will focus on support for clients in the retail, industrial, land, office and non-profit sectors.

About SVN Vanguard

SVN Vanguard is a full-service commercial real estate franchisor of the SVN brand, comprised of over 1,600 commercial real estate Advisors and staff, in more offices in the United States than any other commercial real estate firm and continues to expand across the globe. We believe geographical coverage and amplified outreach to traditional, cross-market and emerging buyers and tenants is the only way to achieve maximum value to our clients. Visit http://svnvanguardsd.wpenginepowered.com for more information.